option greeks pdf

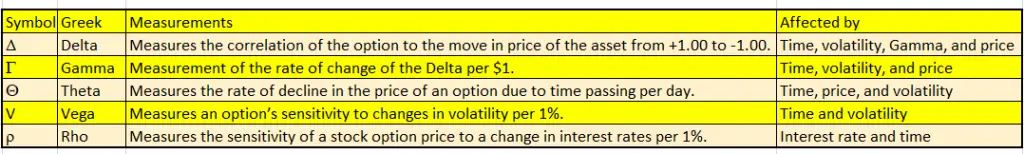

GAMMA The options vega is a measure of the impact of changes in the underlying volatility on the option price. Delta Gamma Vega Theta and Rho are the key option Greeks.

Pdf Trading Options Greeks By Dan Passarelli Ebook Perlego

The delta varies between 0 and 1 for a call option and -1 to 0 for a put option.

. Ey are the key to options risk management. Trading Options DOWNLOAD READ ONLINE Author. It also shows that because of the put-call parity the Greeks of put and call.

Greeks A Greek RISK MEASURE should not be thought of as a single number Rather a range of numbers to be examined in dierent buckets and Under dierent scenarios Saturday August 14 2010 Delta Δ C S Delta is the first partial derivative of an option with respect to the price of the underlying. Delta 13Formula First lets remind the Black-Scholes-Merton formula for a vanilla Call option. The Greeks can help you examine your exposure to various options centric risks.

Option Greeks For Traders written by Simon Gleadall and has been published by this book supported file pdf txt epub kindle and other format this book has been release on 2014 with Electronic books categories. However there are many other option Greeks that can be derived from those mentioned above. These three Greek Risk Gauges are very closely interrelated Due to the potential for price gaps options have whats called convexity The greater the convexity the greater the Gamma for options allowing for the Delta to change more rapidly The delta of the option changes if the underlying changes enough during the time period selected 15.

Delta Gamma Theta Vega and Rho. As usual we will talk about calls - the puts are analogous. Greeks can help.

Download DAN PASSARELLI - TRADING OPTION GREEKS PDF for. CeqTSNd 1 Xe rTNd 2 131 pXerTNd 2 e qTSNd 1 132 With. Specifically the vega of an option expresses the change in the price of the option for every 1 change in underlying volatility.

Theyre used to predict price movements. Vega is not a Greek letter - sometimes λ or κ are used instead The prescribed perturbations in the definitions above are problematic. Vega can be termed as the first derivative of an option price with respect to the volatility of the underlying asset.

The five Greeks that this study will focus on are D elta first derivative of the price of underlying Gamma 2 nd derivative of price Vega volatility Theta. For those not familiar with option pricing it can also be an educational guide as well. Option Greek Delta Delta Δ is a measure of the sensitivity of an options price changes relative to the changes in the underlying assets price.

The different Greeks are. Options are to the particular risk source one should look at the Greeks options Hull 2002 - quanti-ties denoted by Greek letters representing options sensitivities to risk. Or out of the money.

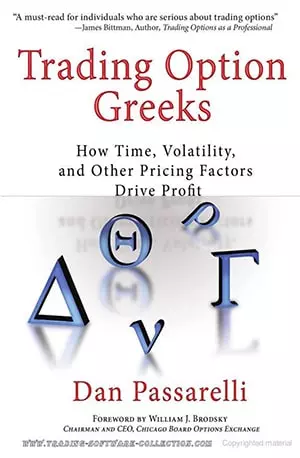

Here is an Option Greeks cheat sheet you can use as a quick reference guide. How Traders Use Option-Pricing Models 24 Delta 25 Gamma 32 Theta 38 Vega 42 Rho 46 Where to Find Option Greeks 51 Caveats with Regard to. Check Pages 1-50 of DAN PASSARELLI - TRADING OPTION GREEKS in the flip PDF version.

For more about option Greeks check out my article- Option Greeks Explained. It is defined as the rate of change of the option price with respect to the price of the underlying asset. DAN PASSARELLI - TRADING OPTION GREEKS was published by MyDocSHELVES DIGITAL DOCUMENT SYSTEM on 2017-10-23.

The predetermined price is known as the strike price and the predetermined date is known as the strike date. OPTIONS GREEKS Study notes 1 Options 11 Basic information An option results in the right but not the obligation to buy or sell an asset at a predetermined price and on or before a predetermined date. THE GREEKS In order to construct the approximate replicating portfolio we have to know by how much the value.

Options that are very deeply into or out of the money have Γ gamma values close to 0. Usually the first thing we want to control. It is more sensible to look at the Greeks as derivatives of option prices in a given model.

First order greeks in Python The Smile of Thales 1Delta 11Definition Delta is the options sensitivity to small changes in the underlying price. 71 76 Vega Vega measures the sensitivity of the option price with respect to the volatility of the underlying asset. Since volatilities change over a certain time period the option premium of both call.

Greeks can help you plan your trades to take advantage of or avoidminimize the effects of these risks. A price of course has to be paid. Greeks are dynamic and constantly changing.

Download View Dan Passarelli - Trading Option Greekspdf as PDF for free. Find more similar flip PDFs like DAN PASSARELLI - TRADING OPTION GREEKS. This paper has proposed new option Greeks and new upper and lower bounds for European and American options.

Jonathon Faucett language. It is the slope of the curve that relates the option price to the underlying asset. Vega is not a Greek letter the Greek letter nu ν is used instead.

The Greeks as theyre known to options traders are the key factors that can influence options pricing. THE BASICS OF OPTION GREEKS CHAPTER 1 The Basics 3 Contractual Rights and Obligations 3 ETFs Indexes and HOLDRs 9 Strategies and At-Expiration Diagrams 10 CHAPTER 2 Greek Philosophy 23 Price vs.

Option Greeks February 8 2016 By Thomas Mann All Things Stocks Medium

Pdf Options Pricing Usage And The Greeks

Option Trading Pricing And Volatility Strategies And Techniques Wiley Trading Series Band 445 Sinclair Euan Amazon De Bucher

Double Barrier Call Option Price And Greeks As A Function Of The Download Scientific Diagram

Pdf Trading Option Greeks Download Book Online

Option Strategies Cheat Sheet New Trader U

Pdf On Volatility Trading Option Greeks Publishing India Group Academia Edu

Pdf Hedging Option Greeks Risk Management Tool For Portfolio Of Futures And Option

Trading Option Greeks By Dan Passarelli Pdf Download Read

Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits 2nd Edition Wiley

Pdf A Study On Risk Hedging Strategy Efficacy Of Option Greeks

Options Pricing Option Greeks Explained Trade Options With Me

Pdf Free Pdf An Option Greeks Primer Building Intuition With Delta Hedging And Monte Carlo Simulation Using Excel By Jawwad Farid On Twitter

Pdf Role Of Options Greeks In Risk Management

Dan Passarelli Trading Option Greeks Pdf

Pdf Download Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits Bloomberg Financial Book 159 Free Download

Option Greeks Cheat Sheet New Trader U

Dan Passarelli Trading Option Greeks Pages 1 50 Flip Pdf Download Fliphtml5

Trading Option Greeks How Time Volatility And Other Pricing Factors Drive Profit Wiley

Comments

Post a Comment